New DigiH4A insights reveal why fragmented regulatory systems and high evidence demands block digital health SMEs in the North Sea Region and outline the strategic path needed to overcome these barriers and achieve reimbursed status.

The European digital health market promises significant opportunities, but for SMEs, turning innovation into paid, widespread adoption remains a complex, country-by-country challenge. This difficulty repeatedly stalls the scale of promising tools, preventing them from reaching patients. To tackle these system-level bottlenecks, establishing workable reimbursement pathways and building trust with real-world evidence (RWE), DigiH4A was launched in October 2024.

To help companies navigate this complexity, the DigiH4A team has produced a report examining how digital health solutions actually reach markets in six North Sea Region countries: Belgium, Denmark, France, Germany, the Netherlands, and Sweden. Drawing on national desk research and interviews with SMEs, the report, led by Biotech Santé Bretagne (BSB) in close cooperation with BAX, highlights what enables progress from pilot to paid deployment, and what slows it down.

These insights are a core building block for DigiH4A's broader objective: delivering a strategic action plan by 2027 that helps payers and decision-makers integrate digital solutions into routine care.

Three main takeaways for SMEs

1. Local evidence is non-negotiable, even with international data

While all six countries are committed to digital health and have established health insurance coverage, gaining access requires more than just international certification. The report's analysis shows that local clinical and economic evidence is paramount.

- Custom requirements: Every country mandates clinical trials, cost-effectiveness analysis, and budget impact data. However, some demand socio-economic evaluations (France, Belgium, Netherlands) , while others specifically require user acceptance studies (Netherlands, Denmark).

- Proof of local value: SME experiences consistently highlight that international evidence is rarely accepted without adaptation to the local clinical setting. Authorities and buyers want to see the solution deployed and proven here.

- Interoperability as a prerequisite: In several countries, technical interoperability: the ability to cleanly integrate with existing health IT systems is a mandatory requirement for evidence submission and often to access reimbursement (France, Belgium, Netherlands).

2. Fragmentation dictates strategy: choose your entry point wisely

The difficulty of market access is fundamentally tied to the governance model of the healthcare system. SMEs cannot use a "one-size-fits-all" approach.

Countries like Germany and Belgium feature complex regulatory and reimbursement climates that demand substantial localisation efforts (such as multilingual adaptation) and often require navigating decentralised, region-specific processes. Germany's DiGA pathway, while pioneering, is rigorous, highly selective and can be unpredictable.

Denmark and Sweden are digitally mature but highly regionalised. In these markets, access is often achieved through region-by-region public tenders, meaning a successful deal in one area does not guarantee scaling nationwide.

The Netherlands is highly innovative, with a mix of public and private payers. Here, success comes from demonstrating that the product can be woven into existing care pathways and covered through insurer-provider contracts, leveraging efficiency arguments like staff time relief.

3. Success requires parallel business models and persistence

Across the board, the transition from pilot to paid contract is a lengthy, resource-intensive process.

- Bridging the funding gap: Long reimbursement cycles and funding gaps are a common barrier. SMEs must secure robust, long-term funding and pursue parallel revenue streams (e.g., B2B sales to hospitals, direct-to-consumer offers, or insurer partnerships) to sustain momentum while waiting for national or regional coverage.

- Relationships over rules: Early and sustained engagement with local stakeholders (innovation hubs, clinical champions, payers) is critical. In Belgium, for example, relationship-driven commercialisation often outweighs pure technical compliance in driving procurement.

- Anticipate friction: Innovators must cultivate patience and resilience. Expect multiple rounds of feedback, administrative hurdles, and continuous adaptation to evolving local and EU regulations.

DigiH4A’s recommendations for policymakers and HTA bodies

The report’s insights are intended to inform a strategic action plan to lower barriers. Policymakers and Health Technology Assessment (HTA) bodies can accelerate digital diffusion by focusing on these key levers:

- Harmonisation and streamlining: Create clearer and more homogeneous guidelines for evidence and simplify regulatory and reimbursement processes, ideally with transparent timelines and unified submission platforms.

- Strengthening local validation: Bolster regional innovation hubs and clinician-led evaluation panels to reduce administrative friction and strengthen local validation.

- Fostering cross-border learning: Promote cross-country pilot collaboration and mutual recognition of evidence standards to lower entry barriers and scale successful models.

The market’s promise will only be fully unlocked through pragmatic approaches that bridge clinical, economic, and regulatory expectations.

A foundation for future alignment

The comparative analysis shows strong momentum for digital health across the North Sea Region but also highlights significant fragmentation. SMEs face high evidence expectations, varying governance structures, and long decision timelines.

By bringing these insights together, the DigiH4A report provides a clearer picture of how digital health actually enters markets today. It helps innovators plan more effectively and gives policymakers a shared reference point for reducing barriers and simplifying access.

As digital health becomes more central to care, this kind of clarity is essential for ensuring that promising solutions can reach patients faster and more sustainably.

Want to get in touch with the team? Send us an email!

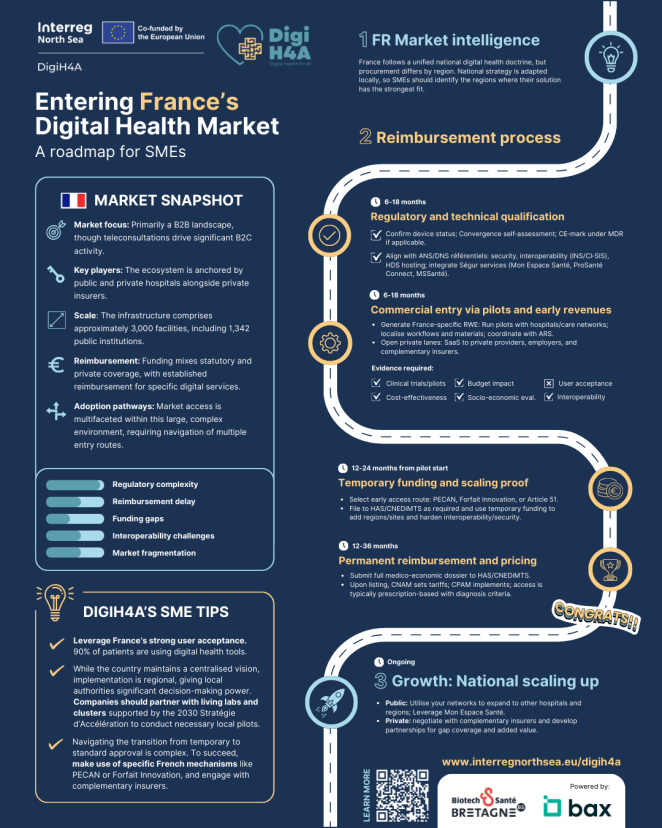

Click to view infographic: Entering France’s Digital Health Market

More country-specific market access infographics are coming in the new year, supporting SMEs navigating digital health markets in Belgium, Sweden, Denmark, Germany and the Netherlands.